hotel tax calculator nc

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. The calculator on this page is provided through the.

Taxfyle Com Tax Bracket Calculator Income Tax Brackets Tax Brackets Income Tax

1 State lodging tax rate raised to 50 in mountain lakes area.

. 2 A state lodging tax is only levied in special statutory designated redevelopment districts at 50. 2019 Individual Income Tax Estimator 2020. Durham County Commissioners levied a Room Occupancy Tax of 6 on gross receipts derived from the rental of any room lodging or accommodation furnished by a hotel motel.

Average Local State Sales Tax. Allowable reimbursement of taxessurchargesfees. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys.

Total taxessurchargesfees hotel bill. Skip to main content Menu. Tax Amount 1.

Percentage of allowable taxessurchargesfees. Is that correct. Have you ever wondered how to calculate the revenue stamps excise tax on the sale of real estate in North Carolina.

This means that depending on your location within North Carolina the total tax you pay can be significantly higher than the 475 state sales tax. Maximum room rate for area traveled. This new sales tax is to be added to the 13 Harmonized Sales Tax HST currently applied to every hotel room in the province.

For calendar 2020 and 2021 an accommodation facilitator was required to file an annual report for its. Currently the hotel tax adds 6 to the 7 sales tax for a total of 13 for each night visitors spend in a hotel in the county. Important note on the salary paycheck calculator.

Answer 1 of 2. North Carolina has a 475 statewide sales tax rate but also has 459 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 222 on top of the state tax. The individual income tax estimator helps taxpayers estimate their North Carolina individual income tax liability.

The equation is 130000 divided by 100 followed by 1300 multiplied by 150. How Income Taxes Are Calculated First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401k. For example if real estate is taxed at 150 per 100 and the purchase price of a piece of property is 130000 then the excise tax is 1950.

You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202223. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. The tax rate is 2 per 1000 of the sales price.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Use ADPs North Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Of that 6 15 funds the Tourism Product Development Fund.

3 State levied lodging tax varies. To calculate the sales tax that is included in. 50 rows 125.

Maximum Possible Sales Tax. Today Ontario Finance Minister Charles Sousa released the 2017-18 provincial budget announcing a new sales tax on hotel rooms in Ontario. To make the easy calculation for lump-sum lottery taxes state-wise in the USA and country-wise for the rest of the world.

No additional local tax on accommodations. The other 45 must go to sales and marketing of Buncombe County and support of local businesses that drive tourism. TaxesSurchargesFees on hotel receipt.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Browse all 30142 North Carolina topics Hotel Taxes in North. North Carolina Income Tax Calculator 2021.

In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes. NA tax not levied on accommodations. There is a variation on lottery tax on winnings according to country policy for lottery winners.

Lottery Tax Calculator calculates the lump sum payments taxes on the lottery and tries to provide accurate data to the user. How To Calculate Excise Tax In Nc. The act went into full effect in 2014 but before then North Carolina had a three-bracket progressive income tax system with rates ranging from 6 to 775.

North Carolina State Sales Tax. How do I figure out sales tax. North Carolina NC North Carolina Travel Forum.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. Individual income tax refund inquiries. Convention hotels located within a.

Daily room charge shown on hotel receipt. Gross receipts derived from the rental of an accommodation and the sales and use tax thereon are to be reported to the Department on Form E-500 Sales and Use Tax Return or through the Departments online filing and payment system. TaxAmount 2 Tax Amount 3 Tax Amount 4.

Our calculator has been specially developed in order to provide the users of the calculator with not. The TPDF is currently paused while the. So if you purchase a home or land for 900000 the revenue tax would be 900000 divided by 1000 and multiplied by 2 which equals 1800.

Maximum Local Sales Tax. North Carolina has not always had a flat income tax rate though. If you make 70000 a year living in the region of North Carolina USA you will be taxed 11498.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Hotel Taxes in North. Calculate excise tax based on a dollar amount.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. For comparison the median home value in North Carolina is 15550000. It is my understanding that in Raleigh lodging rooms are taxed at 135 475 state sales tax 225 county sales tax 6 county occupancy tax.

As Philadelphia Hotel And Sales Taxes Evaporate So Do Millions In Funds Philadelphia Business Journal

Finance Forms Carteret County Nc Official Website

Transient Occupancy Tax Tot Treasurer And Tax Collector

Arizona Sales Tax Small Business Guide Truic

Transient Occupancy Tax Tot Treasurer And Tax Collector

Transient Occupancy Tax Tot Treasurer And Tax Collector

Check Out This Awesome Listing On Airbnb Sugar Creek Treehouse With Hot Tub Treehouses For Rent In Green Mountain Tree House Tree Houses For Rent House

Occupancy Tax Carteret County Nc Official Website

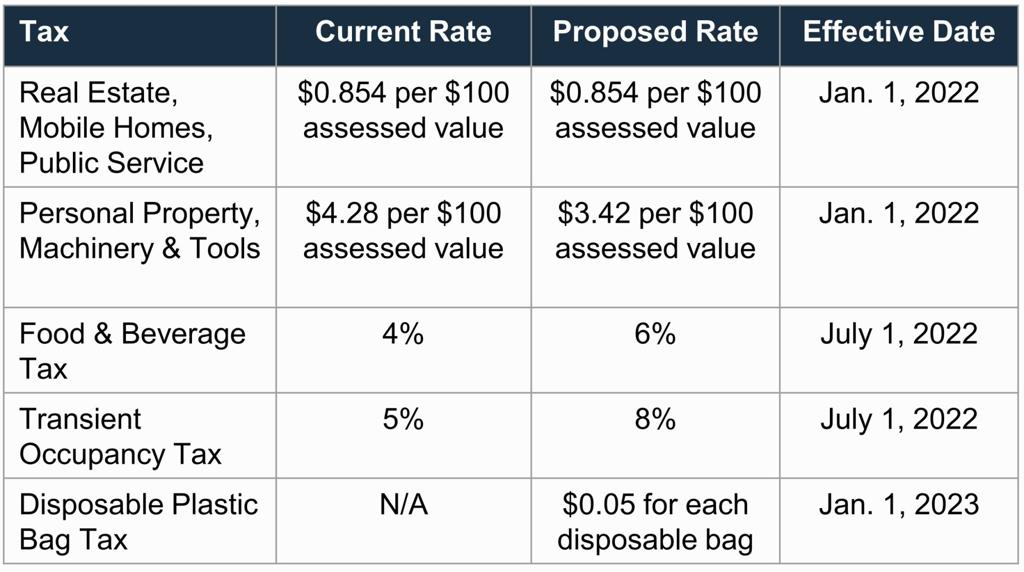

Albemarle Approves 2023 Budget Meals And Hotel Tax Increases Local Government Dailyprogress Com

Solved Is Occupancy Tax Deductible From Income

How Much Is Hotel Tax In Georgia Lexingtondowntownhotel Com

How Much Is Hotel Tax In North Carolina Lexingtondowntownhotel Com

Hotel Prices Why Urban Hotels Cost So Much More Than Houses Or Apartments In The Same City

Albemarle S Budget Proposal Includes Meals Hotel Tax Rate Increases Local Government Dailyprogress Com

Who Pays The Transient Occupancy Tax Turbotax Tax Tips Videos